Published

5 months agoon

By

Adubianews

Governor of the Bank of Ghana, Dr. Johnson Asiama, has expressed confidence that Ghana will successfully exit its current International Monetary Fund (IMF) programme ahead of schedule.

Speaking during an interaction with Abebe Selassie, Director of the IMF’s African Department, on the sidelines of the IMF/World Bank Annual Meetings in Washington DC, Dr. Asiama revealed that Ghana is ahead of most of the targets and benchmarks set under the ongoing programme.

According to him, the country has made significant progress through economic reforms aimed at stabilizing inflation, strengthening monetary policy, and improving fiscal discipline. “We should not forget that when this administration took over, there were concerns that we should cancel the programme, and there were doubts about whether we could carry on with it,” he said. “But the current developments show that we have delivered and turned things around.”

He emphasized that the current Extended Credit Facility (ECF) programme has introduced key structural reforms, especially in enhancing the operational capacity of the Bank of Ghana and improving the country’s monetary policy framework.

Ghana entered into the IMF programme in 2023, which is scheduled to end in May 2026, with the Fund having already disbursed over US$2 billion to support the country’s economic recovery. However, Dr. Asiama’s assurance comes amid speculation that the government might extend the programme to reinforce investor confidence and demonstrate fiscal discipline.

The Governor’s remarks sought to dispel such concerns, highlighting Ghana’s progress in restoring macroeconomic stability. He credited the IMF for its vital role in helping Ghana overcome inflationary pressures and other structural challenges.

Dr. Asiama noted that when the administration assumed office, inflation was high and economic conditions were difficult. “We met an economy that was challenged, with high levels of inflation, and this was our priority when this administration took over,” he stated.

He explained that the Bank of Ghana implemented decisive measures, including tightening monetary policy and improving liquidity management. As a result, inflation has dropped significantly to 9.4 percent as of September 2025. “Our policies, going forward, will be data-driven and adaptable to changes in the economy,” he added.

On sustaining inflation within target levels, Dr. Asiama stressed the importance of maintaining sound monetary and exchange rate policies to preserve recent gains.

He also commended the Gold for Reserves Programme, describing it as a major success that has strengthened Ghana’s international reserves and enhanced financial stability.

In addition, he revealed that the Bank of Ghana, working closely with the IMF, has developed a new structured foreign exchange operations framework. This initiative, he said, aims to manage FX flows more efficiently, reduce market volatility, and build stronger reserves. “As these framework changes take place, they will bring further transparency to our foreign exchange market operations and help ease volatilities in the market,” Dr. Asiama explained.

Ghana Set to Exit IMF Programme as Government Moves to Clear Stalled Project Debts

IMF Deal Bars Mahama Government from Issuing Sovereign Guarantees — Bright Simons

IMF Did Not Mislabel Ghana’s Gold Losses – Bright Simons Pushes Back

Ghana Exempted from Latest US Visa Restrictions, Says Ablakwa

Ghana Slams Israel Over “Inhumane” Treatment of Travellers, Orders Reciprocal Deportations

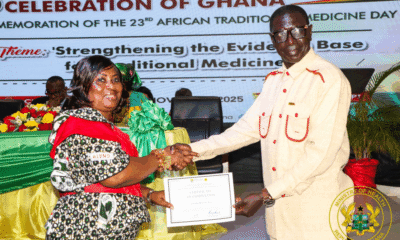

Ghana Reaffirms Commitment to Evidence-Based Traditional Medicine at African Traditional Medicine Day

Ghana Condemns Israeli Airstrikes on Qatar, Calls It a Violation of International Law

Ghana Prepares to Exit IMF Programme in May 2026 with Investor Reassurance Plans

Ghana to Hold State Funeral for Helicopter Crash Victims on August 15