GENERAL

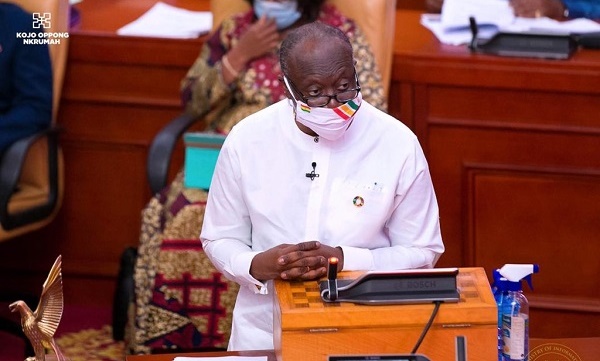

Ken Ofori-Atta: Ghana’s public debt GHS334bn – 77.1% of GDP.

Published

3 years agoon

By

Joe Pee

Ghana’s provisional nominal debt stock as of end-June 2021 stood at GHȼ334,560.4 million (US$58,041.1 million), representing 77.1 per cent of GDP, Finance Minister Ken Ofori-Atta has told parliament his mid-year budget review on Thursday, 29 July 2021.

This was up from GHȼ291.6 billion (US$50.8 billion) at the end of December 2020.

This stock included the financial and energy sector bailouts.

Excluding the financial sector bailout, the nominal debt stock as percentage of GDP falls to 72.9 per cent, Mr Ofori-Atta said.

The increase in the debt stock, he noted, “”was mainly because of the Eurobond issuance in April 2021, COVID-19 pandemic effect, contingent liabilities, and front-loading of financing to meet cash flow requirements for the first half of the year.

The composition of the total debt stock was made up of a provisional amount of GHȼ161,813.48 million (US$28,072.15 million) and GHȼ172,746.95 million (US$29,968.94 million) for external debt and domestic debt, respectively, which correspondingly accounted for 48.4 per cent and 51.6 per cent of the total debt.

Read below excerpts of the mid-year budget review:

Domestic Market Developments

Mr. Speaker, a new Bond Market Specialist has been engaged and the implementation of the revised Primary Dealer guidelines have commenced since June 2021. This replaced the previous mechanism.

Already, we are seeing positive performances from the implementation of this reform.

Arising from this, a new Borrowing Guideline for 2021 has been published, detailing to the market the various instruments to be offered in 2021. The accompanying issuance calendars would be published on a 3-month rolling basis.

Update on Ghana’s Credit Ratings for 2021

Mr. Speaker, only one credit rating action was conducted on Ghana during the first half of 2021. Fitch Ratings, on 22nd June, 2021, affirmed Ghana’s Long-Term Foreign-Currency Issuer Default Rating at ‘B’, but revised the outlook from stable to negative. The revision in outlook by Fitch was premised on several factors, including: slow rate of fiscal consolidation and public finance challenges emanating from the COVID-19 pandemic; low revenue base; high public debt levels; as well as a lack of a clear majority in Parliament.

Despite the Rating Agency’s stance, Government wishes to reiterate that it has and will continue to take pragmatic actions and policies to reinvigorate the economy in the post COVID-19 era. Government will rebuild the economy and make it more resilient through the implementation of the fiscal measures outlined in the 2021 Budget, this Mid-Year Review, as well as the Ghana CARES Programme to restore growth to the pre-pandemic levels. These measures will ensure that a fine balance is struck between fiscal consolidation and growth.

The International Capital Market Programme for the 2021 and the Medium-Term

Mr. Speaker, legislative approvals were given to conduct an international capital market programme issuance for multiple instruments for 2021.

The issuance size was targeted for US$3.0 billion with a possibility of increasing that to US$5.0 billion for financing growth-oriented expenditures and liability management for domestic and external debt.

Mr. Speaker, following a three-day virtual roadshow out of Accra with a series of fixed-income investor meetings based mainly across North America and Europe, Ghana issued its first 4-tranche zero coupon Eurobond transaction under its 2021 International Capital Markets Programme for US$3,025 million.

The transaction had a debut US$525 million for a 4-year tenor zero coupon bond.

In addition to this, a regular tranche consisting of US$1 billion for a 7-year tenor, US$1 billion for 12-year tenor, and US$500 million for 20-year tenor were issued. The three bonds were priced at coupon rates of 7.75 per cent, 8.625 per cent, and 8.875 per cent, respectively.

Ghana, therefore, became the:

• First ever country in the emerging market country group to issue a zero-coupon bond on the ICM;

• First largest emerging market sovereign deal maker early in 2021; and

• First African country with a 4-tranche issuance.

The capital markets, therefore, affirmed its continued confidence in the Ghanaian economy with this issuance.

Mr. Speaker, the United Nations Sustainable Development Goals (SDGs) call for urgent action by all countries aimed at encouraging sustained economic growth underpinned by social, economic and environmental sustainability—a blueprint for peace and prosperity for people and the planet, now and in the future.

Accordingly, the Government of Ghana recognises that we must do our part to rebuild and promote the building blocks for an inclusive and sustainable recovery. Our focus remains moving urgently toward opportunities and solutions that achieve sustainable and broad-based economic growth without harming our climate or leaving hundreds of millions of families in poverty.

You may like

-

Freemasonry is not for the elite only – Maxwell Kofi Jumah (Video).

-

Jesus commanded human beings to drink alcohol – Maxwell Kofi Jumah (Video).

-

Million-dollar sweater: Bids pour in for Princess Diana’s sheep jumper

-

Queenmothers launch campaign to promote decent language in politics

-

Watch Adwoa Safo’s apology to NPP leadership and members

-

Share rent, other bills with your husbands – KieKie admonishes women

-

Minimalism in Everyday Life: Decluttering for a Simpler Lifestyle

-

US Open: American teenager Coco Gauf wins first Grand Slam title

-

Alan Kyerematen withdraws from NPP flagbearership race